Medium-term Management Plan

Background to formulating the Medium-term Management Plan

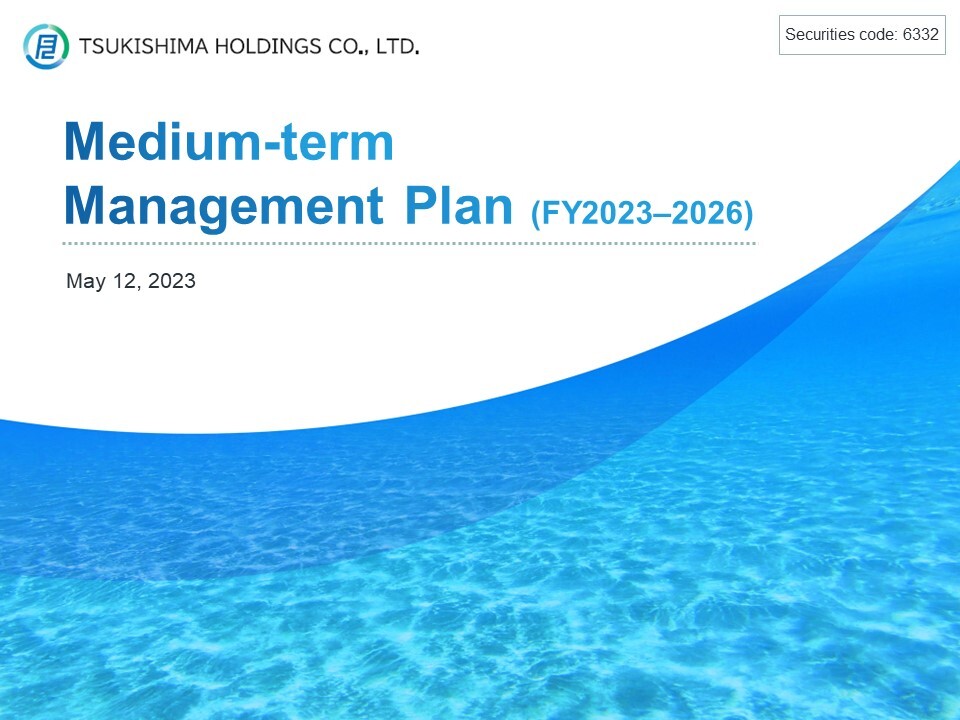

To clarify our future aims and raison d'etre, we have formulated a new corporate Purpose, Group Corporate Policy, and Long-term Vision and identified materiality issues for achieving the Long-term Vision.

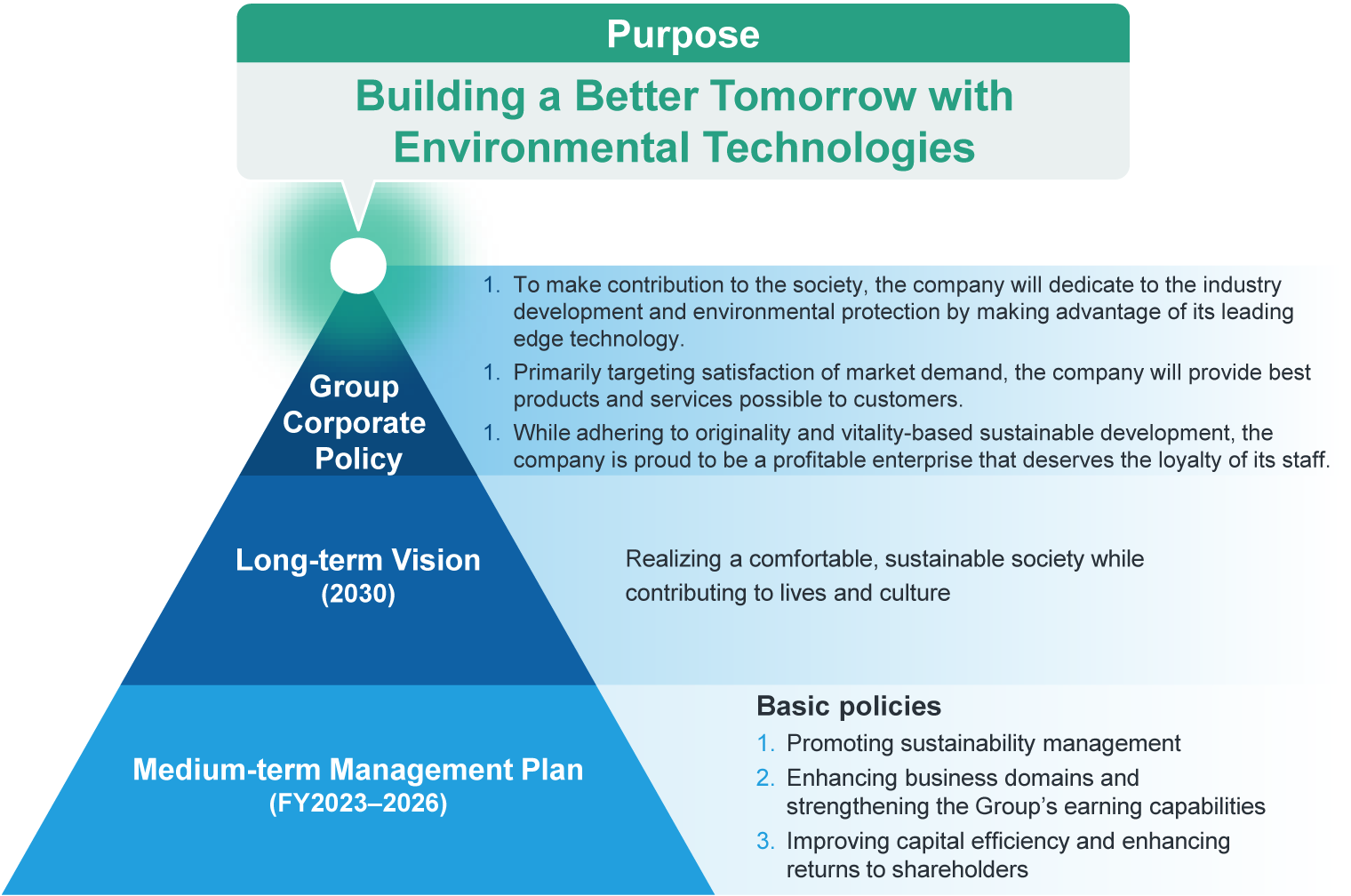

We have formulated the Medium-term Management Plan as the first step toward the Long-term Vision for 2030.

By promoting this Medium-term Management Plan, we will seek to realize sustained growth and further increases in our corporate value.

Overview of the Medium-term Management Plan

The Medium-term Management Plan has three basic policies: Promoting sustainability management; enhancing business domains and strengthening the Group's earning capabilities; and improving capital efficiency and enhancing returns to shareholders.

By implementing these measures, we will seek to achieve net sales of 160.0 billion yen and operating profit of 12.0 billion yen in the fiscal year ending March 2027.

Promoting sustainability management

We will pursue sustainability management to achieve sustained business growth alongside our stakeholders by solving various environmental and social issues.

- Contributing to a decarbonized society through businesses

- Developing rewarding workplace environments and systems, promoting diversity and inclusion, and enhancing human resource development

- Further enhancements in governance

Enhancing business domains and strengthening the Group's earning capabilities

In both the Water Environmental Business and the Industrial Business, we will shift business domains toward environmental businesses to contribute to a decarbonized society and to high added value (priority area) domains such as public-private partnerships, where strong growth is anticipated, to improve the Group's earning capabilities.

Water Environmental Business

- Generating synergies with JFE Engineering Corporation (domestic water engineering business)

- Enhancing energy creation businesses (sludge to fuel, digestion gas power generation)

- Enhancing public-private partnership (PPP) initiatives

Industrial Business

- Enhancing competitive strengths in fine particle manufacture technologies in the battery business and other fields

- Decarbonization technology initiatives (technologies for ammonia recovery and use)

Common to both businesses

- Shifting business domains toward environmental businesses to contribute to a decarbonized society and to high added value (priority area) domains such as public-private partnerships, where strong growth is anticipated

- Improving earning capabilities through enhancements of Group corporate management and strategic functions

Improving capital efficiency and enhancing returns to shareholders

We will implement the following measures to improve capital efficiency and enhance returns to shareholders:

- Adding return on invested capital (ROIC) as a key performance indicator (KPI) and setting ROIC and Return On Equity (ROE) figures in financial targets.

Improving Price Book-value Ratio (PBR) by improving capital efficiency and promoting corporate value management based on a keen sense of capital costs. - Formulating capital allocation plans and optimizing allocation to investment and shareholder returns.

Continuing to reduce cross-shareholdings with a cumulative sales target of 3–5 billion yen in cross-shareholdings over four years, to levels not exceeding 20% of consolidated net assets.

Expand the sales amount of cross-shareholdings, we have revised our target sales amount to more than 7 billion yen. - Actively providing returns to shareholders with a targeted total return ratio of 50% or more and a dividend return ratio of 40% or more.

Furthermore, the target dividend return ratio for FY2024 will be expanded to 50% or more by further expansion of cross-shareholdings reduction and revising the timing of capital investments under consideration.

Controlling equity capital through continual increases in dividends and dynamic purchase of treasury shares.

See below for details of the Medium-term Management Plan.

Action to

Implement Management

that is Conscious of Cost of Capital and Stock Price

See below for our activity of the Action to Implement Management that is Conscious of Cost of Capital and Stock Price.