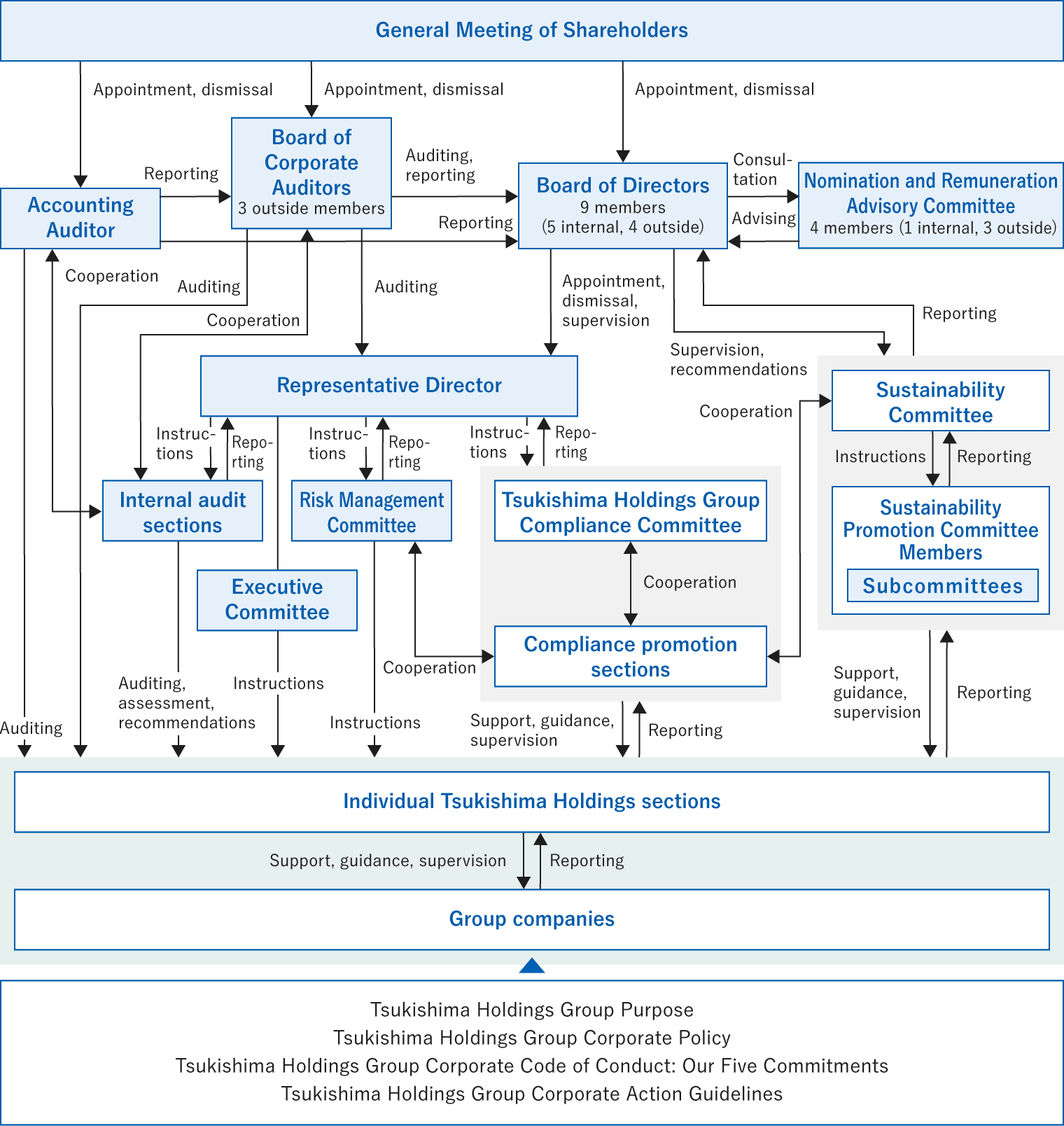

Corporate Governance

Basic concept

We recognize the importance of enhancing corporate governance to ensuring the Groupʼs growth and development. With the global environment in which the Group operates undergoing rapid change, we determined that transitioning to a holding company structure would be the best move to ensure a management structure for sustained growth. In April 2023, we effected this transition and changed the company name to Tsukishima Holdings Co., Ltd. The holding company undertakes the duties of the Group strategy formulation and governance, allowing operating companies to accelerate decision making processes, and we will strive to strengthen corporate value through further progress in Group management efficiency and governance.

Organization (as of June 25, 2024)

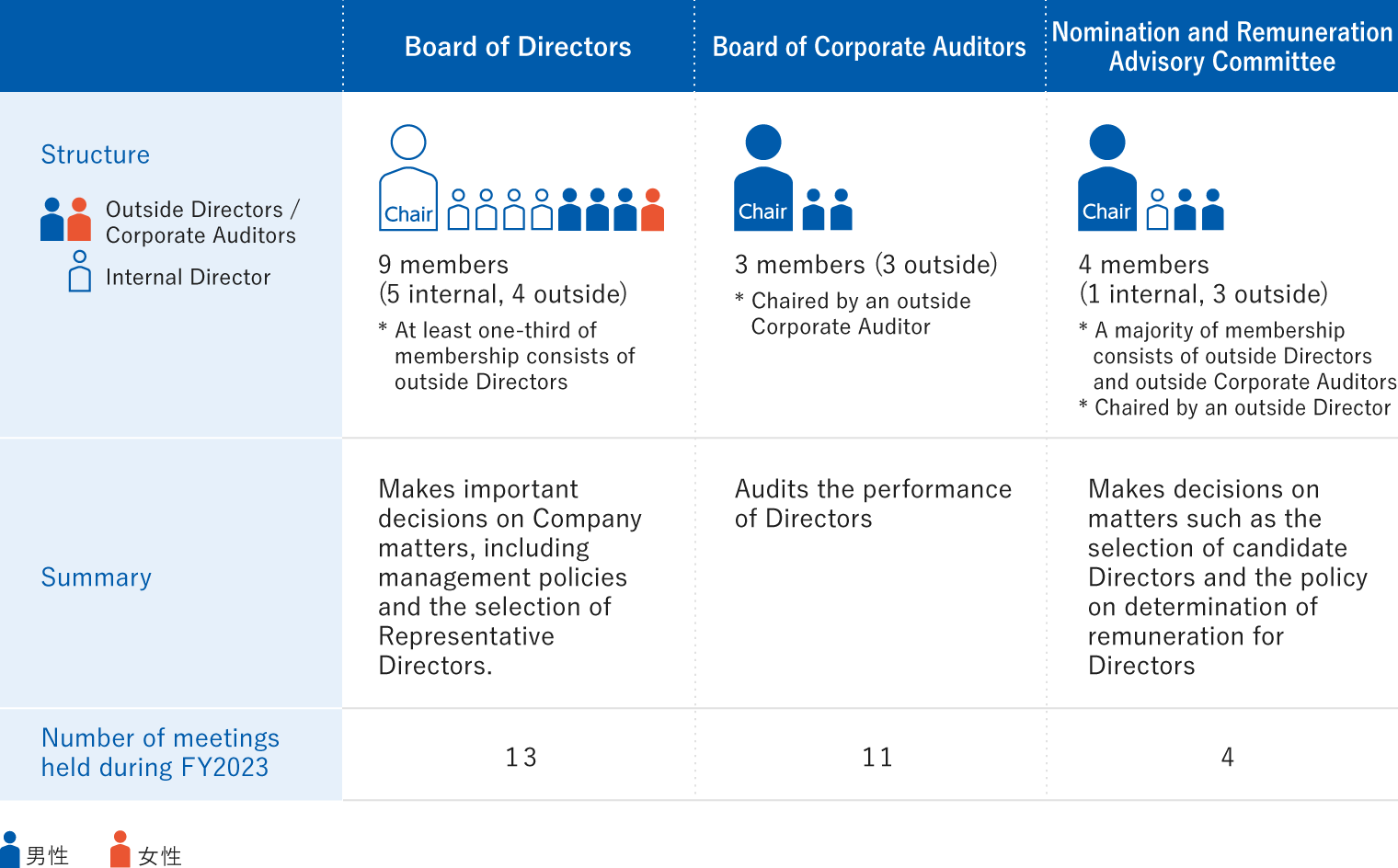

Board of Directors and committee membership, summary, and meetings held (FY2023)

Director and Corporate Auditor selection process

|

Policies |

|

|---|---|

|

Procedures |

|

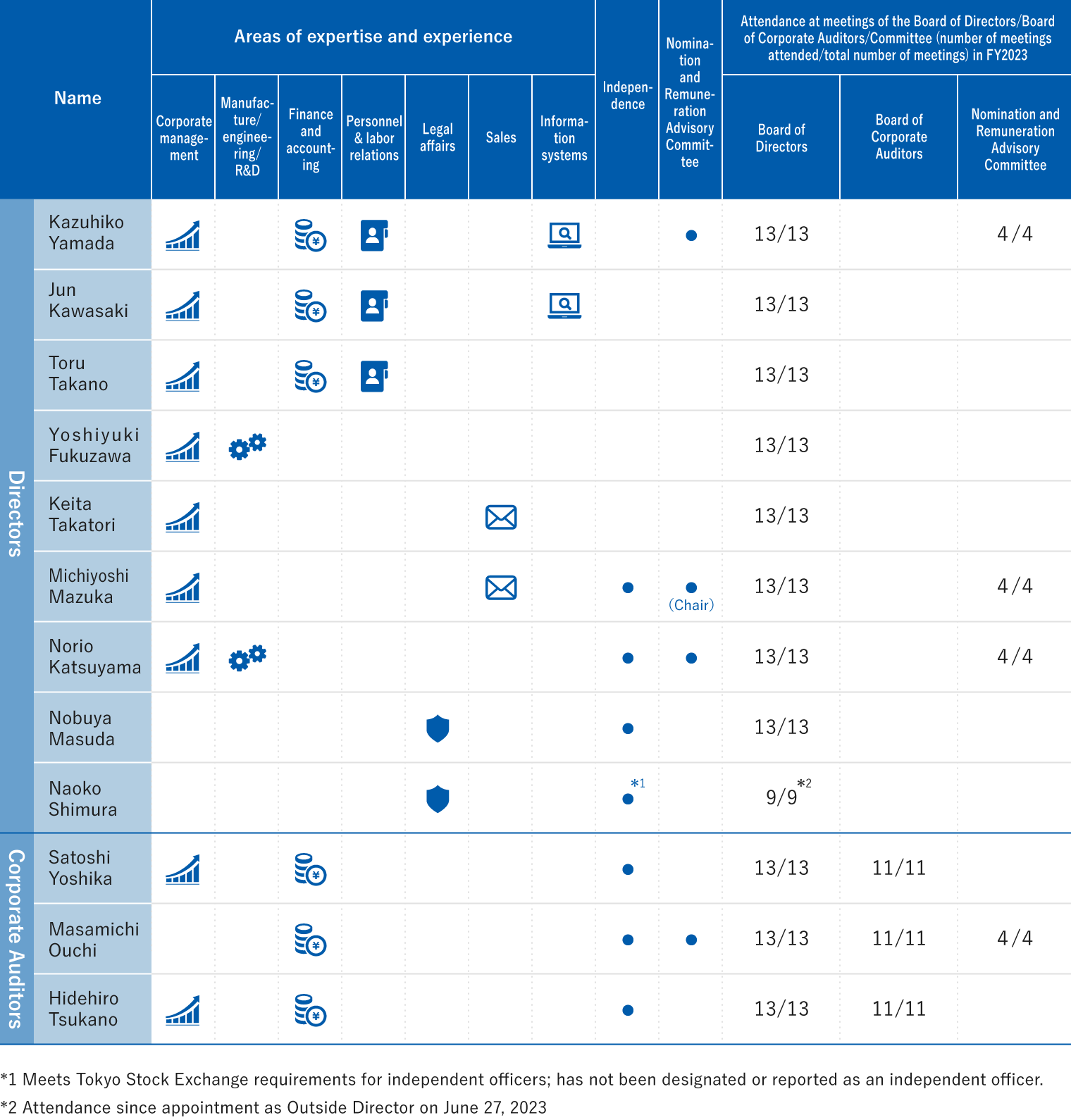

Skills matrix and meeting attendance

(as of June 25, 2024)

Evaluating the effectiveness of the Board of Directors

To verify the effective functioning of the Board of Directors and improve its effectiveness, we seek out advice from outside experts; conduct annual surveys of all Directors and Corporate Auditors; and analyze, assess, and deliberate on the Board based on the survey results.

Executive Remuneration

Basic policy

With the need in mind to secure and maintain capable human resources, the remuneration structure for Company Directors incorporates incentives to improve results and strengthen corporate value. Remuneration decisions for individual Directors are based on the policy of maintaining appropriate pay in light of executive position, responsibilities, and contributions to business performance.

Decision-making process for executive compensation

Remuneration for Directors other than outside Directors consists of a fixed remuneration, remuneration in the form of shares of stock with transfer restrictions, and performance- linked remuneration reflecting business performance and progress with the Medium-term Management Plan and the targets achieved. Remuneration for outside Directors, charged with oversight functions, consists of fixed remuneration that reflect their specified duties. Ratios of allotment of each type of remuneration are based on remuneration at companies of roughly the same size as the Company in related industries and businesses. Decisions concerning remuneration for individual Directors and the composition of the total pay are entrusted by the Board of Directors to the Chairman & Representative Director. The range of possible remuneration is determined in general meetings of shareholders. Decisions by the Chairman & Representative Director on individual remuneration amounts are made in consultation with the Nomination and Remuneration Advisory Committee, to ensure conformity to related policies and fairness. The Nomination and Remuneration Advisory Committee validates amounts of fixed remuneration, remuneration in the form of shares of stock with transfer restrictions, performance-linked remuneration (using consolidated operating income and consolidated net income as indicators), and individual evaluations for each post and recommends to the Chairman & Representative Director a final amount of individual remuneration and final allotment percentages of different types of remuneration, who treats the Nomination and Remuneration Advisory Committee’s recommendations with the utmost respect. The Board of Directors makes final decisions on amounts of executive remuneration by judging whether the details decided on conform to the decision-making policies, including receipt of reports from the Nomination and Remuneration Advisory Committee summarizing its deliberations. To support their independence, remuneration for Corporate Auditors consists of fixed remuneration only, and related decisions are made in accordance with the duties of each Corporate Auditor, in consultation with the Corporate Auditors.

Matters related to performance-linked remuneration

Decisions concerning performance-linked remuneration account for business performance and progress on the Medium-term Management Plan. Specifically, monthly remuneration is calculated based on annual consolidated operating income and consolidated net income planned for the current fiscal year, using as a factor the degree to which these target indicators set in the previous fiscal year are met to reflect the degree of contribution to business performance. In consultation with the Nomination and Remuneration Advisory Committee, in a meeting in February 2023 the Board of Directors added consolidated net income to consolidated operating income as an additional indicator. This reflects the judgment that use of consolidated net income, which is directly related to ROE and other final profit/loss indicators, in addition to consolidated operating income, which indicates overall profits for the Group’s core businesses, will contribute to stronger overall corporate value.

Matters related to remuneration in the form of shares of stock with transfer restrictions

Company Directors other than outside Directors are compensated in the form of shares of stock with transfer restrictions. Such non-monetary remuneration is intended as an incentive toward sustained growth in corporate value and to enhance sharing of value with shareholders. At a certain time after the regular general meeting of shareholders each year, this remuneration is paid through transfer in kind of the entire amount of monetary remuneration claims payable to each post. If the Director resigns from the Company before the end of the period for which transfer of the shares is restricted-a period ranging from three to 30 years, as determined by the Board in advance-for reasons other than expiration of his or her term of office, death, or other valid reason, the allotted shares will revert gratis to the Company. In a case of resignation for valid reasons, the number of shares for which transfer restrictions are waived and the timing of such waiver shall be subject to reasonable adjustment as necessary; the Company acquires gratis any shares for which the restrictions are not waived immediately after the waiver of the restrictions.

Internal controls

An internal controls system is key to ensuring effective and proper company business operations. The Company has established a Basic Policy on the Development of an Internal Controls System and develops and operates its internal controls system in accordance with this policy. As part of our governance structure, we restructured our internal controls system on the transition to a holding company structure, to enhance risk management and compliance.

See our website, Business Report, Corporate Governance Report, Securities Report, and other materials for an overview of the Basic Policy on the Development of an Internal Controls System and its implementation status.