TCFD initiatives

We regard our response to climate change as a key management issue, and have established the Sustainability Committee to promote efforts to realize a sustainable society. Additionally we have declared our support for the recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD*) and disclosed information with such recommendations in mind. While striving to respond to climate change in increasingly advanced ways through our business activities and related disclosures, we will continue to assess the financial impact of the risks and opportunities associated with climate change and promote efforts to reduce these risks as well as capitalize on any opportunities.

Task Force on Climate-related Financial Disclosures:

Task force established in 2015 by the Financial Stability Board (FSB) in response to a G20 request to promote disclosure by businesses and other parties on governance, strategy, risk management, and KPIs and targets related to climate change risks and opportunities

Governance

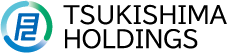

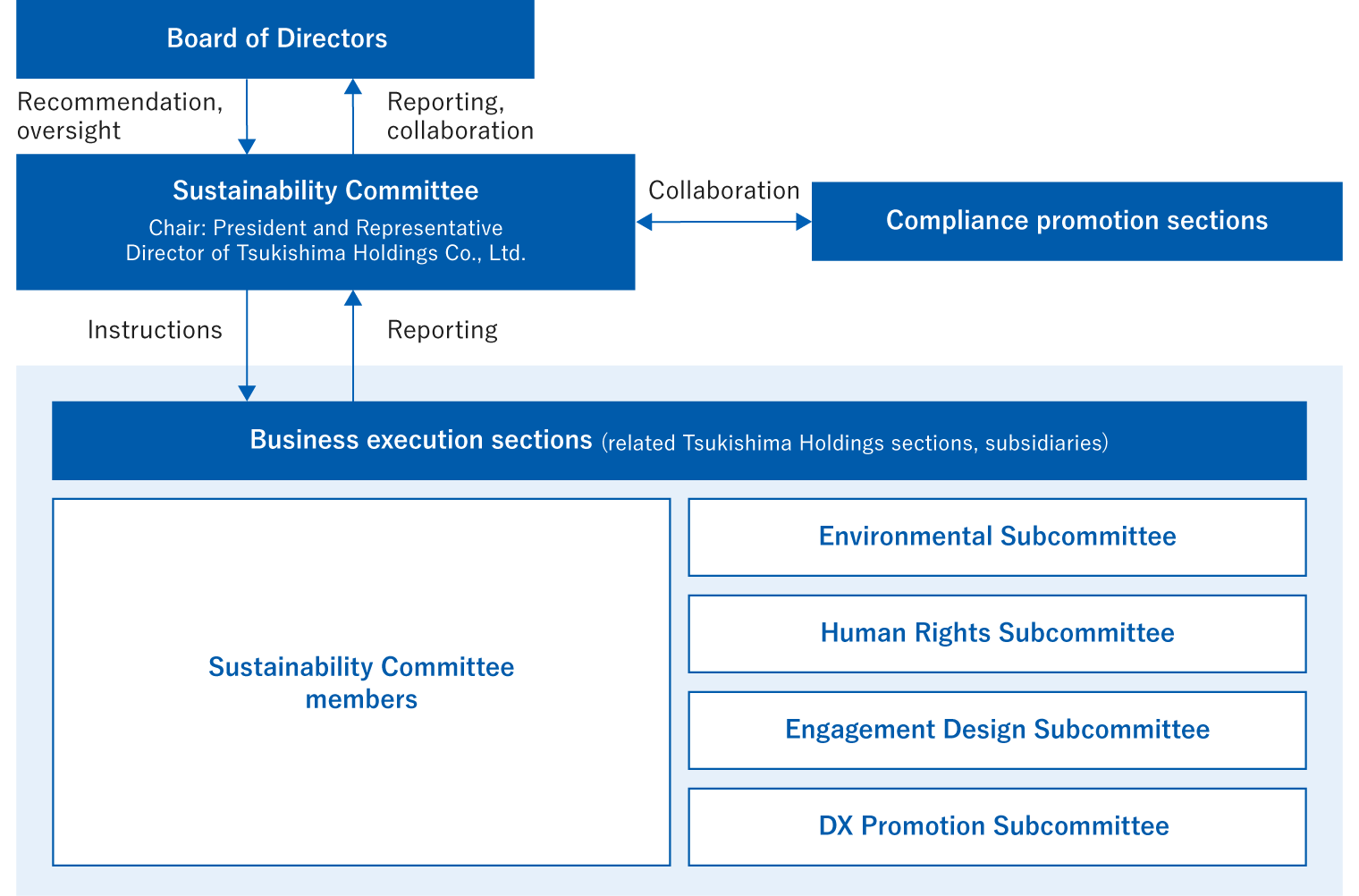

Under a structure whereby the Board of Directors oversees progress, we have established the Sustainability Committee to advance initiatives throughout Tsukishima Holdings on a companywide basis on the risks and opportunities related to climate change.

The subcommittees established under this committee study and promote individual measures. Results of discussions in the Sustainability Committee are reported to the Board of Directors for review.

The Sustainability Committee analyzes the impact of emerging risks and opportunities and monitors the state of responses as important items on the committee's agenda. Information on this state is shared with the compliance promotion section, and risks of particular importance from a business perspective are identified, assessed, and reported to the Board of Directors.

Strategy

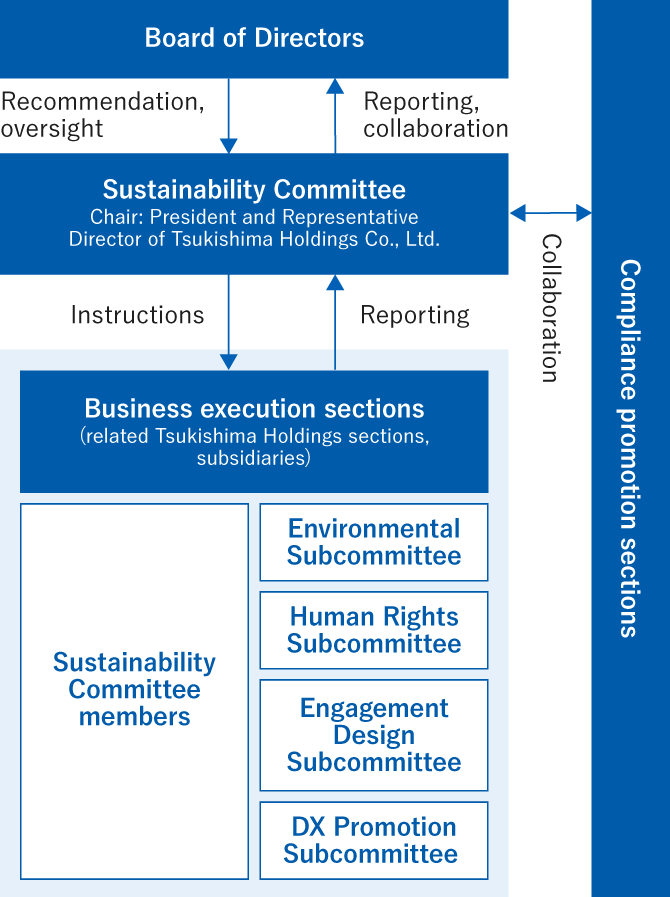

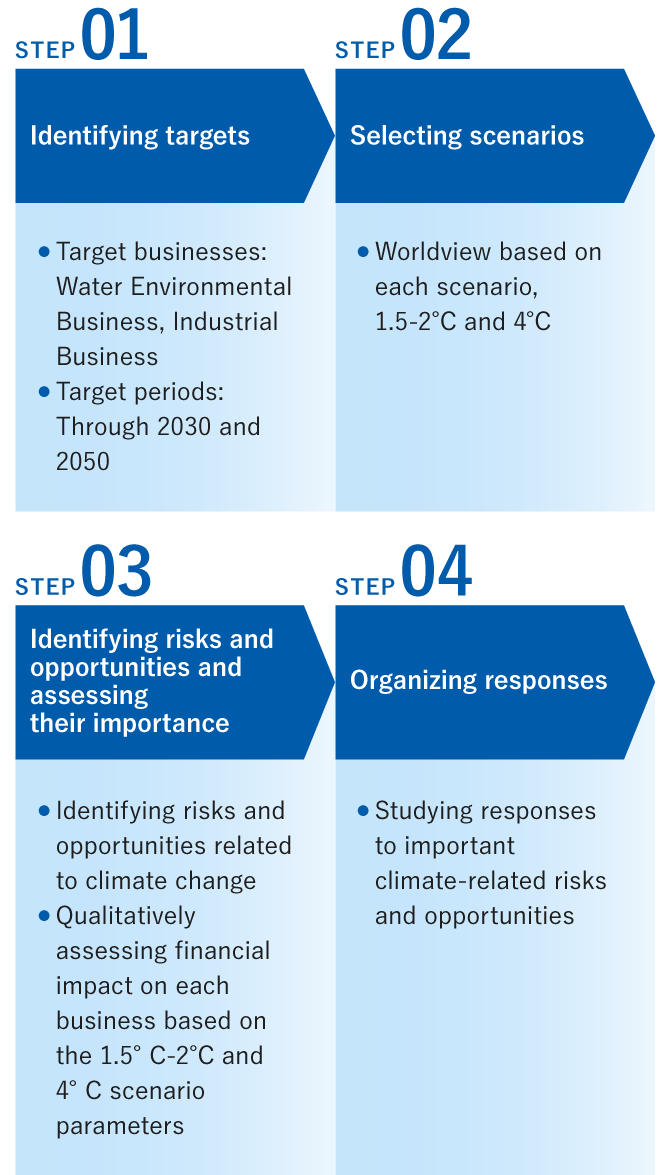

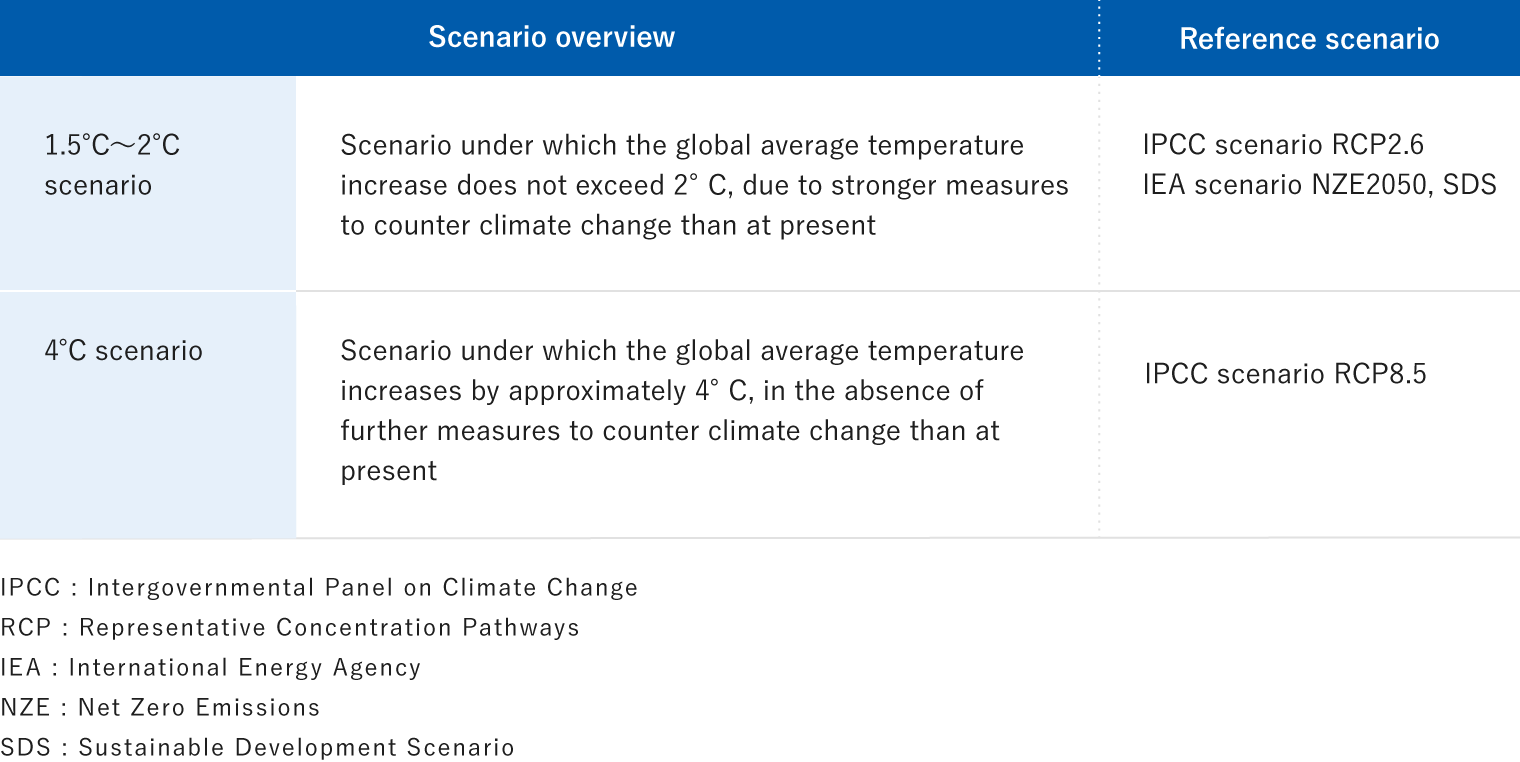

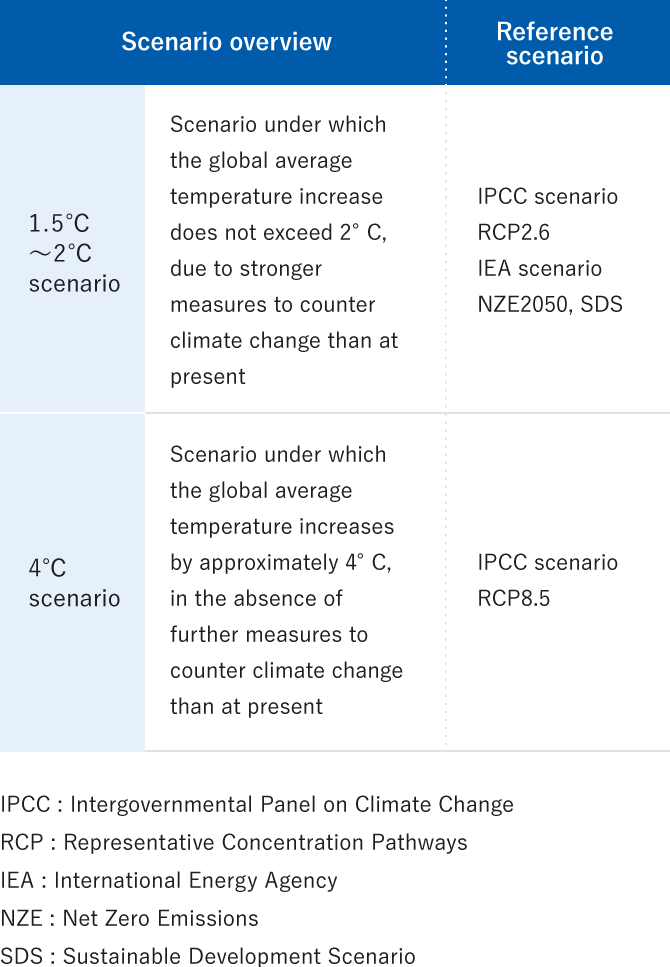

We implemented scenario analysis to ascertain the business impacts of climate change, identifying important risks and opportunities under the 1.5–2°C scenario (IPCC scenario RCP2.6, IEA scenario NZE2050) and the 4°C scenario (IPCC scenario RCP8.5). Then, we placed these on a time axis in accordance with their impacts, both short term (now through 2030) and long term (through 2050).

See here for more information.

Our goal is to make the Group’s businesses more resilient by linking our responses to the risks and opportunities identified through this process to our next medium term management plan.

Risk management

We will expressly confirm, in subcommittees and in other organizations, the status of the implementation of and progress on measures to address climate change risks throughout Tsukishima Holdings. Those identified as measures under the medium-term management plan will be incorporated into the execution plans of each section and their progress managed accordingly. Subcommittees will review climate change risks and opportunities at least once annually and continue to assess their impacts and study response policies. The Sustainability Committee will deliberate on the results and report them to the Board of Directors.

Climate change risks approved in the Sustainability Committee will also be shared with the compliance promotion section. Companywide risks identified by the compliance promotion section will be integrated with climate change risks confirmed by the Sustainability Committee. Risks of special importance from a business perspective will be identified, assessed, and reported to the Board of Directors.

Key Performance Indicator(KPI) and targets

Management of emissions reduction targets will begin with Scope 1 and 2 emissions. We plan to promote efforts to disclose Scope 3 emissions in the future. Having set the goal of achieving net zero CO2 emissions in FY2050, we will promote energy conservation, the use of renewable energy in our business activities, and other measures.